reit tax benefits uk

Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of. REITs are generally tax-efficient vehicles that allow investors to avoid being double taxed.

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the.

. The main tax implications of electing for REIT status are. Hence you do not need to pay taxes on the REIT dividends you get from your ISA. In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions.

After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and sovereign wealth funds 75 100 333 Overseas investor. The REIT is exempt from UK tax on the income and gains of its property rental business. A real estate investment trust REIT is a property investment company which very broadly simulates from a tax perspective direct investment in UK property and so avoids the.

REITs benefit from some pretty special tax advantages. A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property. REIT Tax Benefits No.

If completing the return online in the section Other UK Income tick. Real estate trusts are a different animal from typical corporations. REITs benefit from some pretty special tax advantages.

Corporation Tax is payable on its profits and gains from. You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs. For UK resident individuals who receive tax returns the PID from a UK REIT is included on the tax return as Other Income.

So it makes sense that their accounting practices. Qualifying property companies can elect for REIT status. If the REIT held the property for more than one year long-term capital gains rates apply.

In their simplest tax form a REIT functions like a hybrid of the two and provides the best. REITs are taxed as a corporation but are also afforded some of the benefits of a flow through entity. An overview of the tax structure of REITs and the applicable conditions.

This guide looks at the tax treatment of UK REITS. The main rules for UK-REITs were introduced as FA. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while.

Depreciation and Return of Capital. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. UK REITs are not taxed at the corporation level the REIT dividends paid out to.

A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. The benefits are considerable. Births death marriages and care.

A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received. 2 Distributions are not guaranteed and may be funded from. Advantage 3 - Tax Efficiencies.

Uk Reit Conversion And Institutional Ownership Dynamic Emerald Insight

Uk Reits Don T Like Mondays Emerald Insight

Reit Stocks 150 Real Estate Investment Trusts To Buy Freetrade

Pdf The Impacts Of Tax Reforms On Reits An International Empirical Study

Reits Uk Explained How To Invest In Property Using Reits Real Estate Investment Trusts Youtube

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

How To Invest In Reits In The Uk Raisin Uk

How To Invest In Real Estate The Motley Fool

Reit Dividends And Uk Tax Assura

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Are Reits As Attractive As We All First Thought Financial Times

Uk Reits A Summary Of The Regime Fund Management Reits Uk

Taxation Of Real Estate Investment Trusts Tax Systems

Talking About Regulation Afire

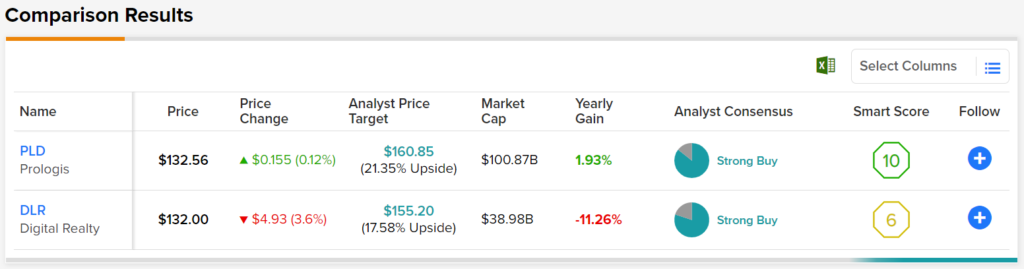

These Two Reits May Benefit From Rising Interest Rates

:max_bytes(150000):strip_icc()/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest